oklahoma state auto sales tax

Multiply the vehicle price after trade-ins and incentives by the sales tax fee. This is the largest of Oklahomas selective sales taxes in terms of revenue generated.

Friends Dads Osu Car Love It Oklahoma State Football Oklahoma State Cowboys Oklahoma Football

As of July 1 2017 Oklahoma charges a 125 percent sales tax on vehicle purchases in addition to motor vehicle taxes.

. Oklahoma has a statewide sales tax rate of 45 which has been in place since 1933. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20 of the average retail value of the car regardless of condition. When a vehicle is purchased under current law a sales tax of 125 percent is levied on the full price of the car.

State Assessment - Public Service Section Forms Publications Legislative Information Mapping Assessors Only Site Sales Use Tax Retailer and Vendor Information Information for Cities and Counties Sales Use Tax PublicationsCharts Sales Use Tax Tools. Oklahoma OK Sales Tax Rates by City. The sales and use tax makes up 33 percent of total state and local tax revenue.

Rates include state county and city taxes. 2020 rates included for use while preparing your income tax deduction. OKLAHOMA CITY The Oklahoma State Senate passed a bill to reinstate full sales tax exemptions on motor vehicles and trailersSenate Majority Leader Kim David presented State Bill 593 on Tuesday.

The value of a vehicle is its actual sales price. 31 rows The latest sales tax rates for cities in Oklahoma OK state. For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter.

With local taxes the total sales tax rate is between 4500 and 11500. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. The annual registration fee for non-commercial vehicles ranges from 15 to 85 depending on the age of the vehicle.

For example imagine you are purchasing a vehicle for 50000 with the state sales tax of 325. The state sales tax rate in Oklahoma is 4500. Most vehicles all terrain vehicles boats or outboard motors are assessed excise tax on the basis of their purchase price provided.

This means that depending on your location within Oklahoma the total tax you pay can be significantly higher than the 45 state sales tax. Registration fees are. If the purchased price falls within 20 of the.

Municipal governments in Oklahoma are also allowed to collect a local-option sales tax that ranges from 035 to 7 across the state with an average local tax of 4264 for a total of 8764. Oklahoma has a lower state sales tax than 885. The public can also request a copy of the agenda via email or phone.

Darcy Jech R-Kingfisher would modify this calculation so the sales tax would be based on the. In Oklahoma this will always be 325. Printable PDF Oklahoma Sales Tax Datasheet.

The Senate has approved a measure that would modify the calculation of sales tax applied to vehicles. The excise tax is 3 ¼ percent of the value of a new vehicle. Your exact excise tax can only be calculated at a Tag Office.

OK Sales Tax Calculator. Together these two motor vehicle taxes produced 728 million in 2016 5 percent of all tax revenue in the state. In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

4334 NW Expressway Suite 183. Oklahoma excise tax provided they title and register in their state of residence. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price.

It produced over 45 billion in 2016. Oklahoma has a 45 statewide sales tax rate but also has 469 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4247 on top of the state tax. This is only an estimate.

Oklahoma City OK 73116. This means that an individual in the state of Oklahoma who sells school supplies and books would be required to charge sales tax but. An example of an item that exempt from Oklahoma is prescription medication.

Senate Bill 1619 authored by Sen. The actual excise tax value is based on the Blue Book value as established by the Vehicle Identification Number VIN. Sales tax revenue grew at an average annual rate of two percent from 2006.

The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. This method is only as exact as the purchase price of the vehicle. When considering all Oklahoma governments together the sales and use tax is the single largest source of revenue.

Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11. Use our OkCARS - Sales and Excise Tax Estimator to help determine how much sales and excise tax you will pay on your new purchase. Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

Used Cars Trucks Suvs In Southwest Ok Solutions Auto Group

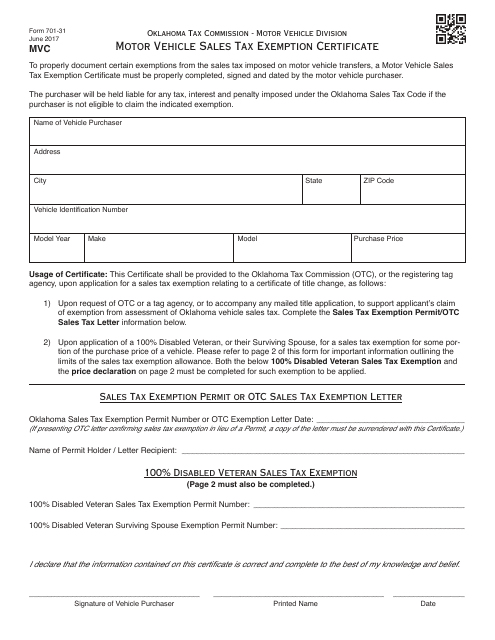

Otc Form 701 31 Download Fillable Pdf Or Fill Online Motor Vehicle Sales Tax Exemption Certificate Oklahoma Templateroller

Oklahoma Vehicle Registration And Title Information Vincheck Info

Senate Approves Bill Eliminating Motor Vehicle Sales Tax Okw News

Free Copies Of Vehicle Registration Now Available Online Kfor Com Oklahoma City

Used Cars Trucks Suvs In Southwest Ok Solutions Auto Group

![]()

Oklahoma Vehicle Registration And Title Information Vincheck Info

Oklahoma Auto Dealer License Guide Surety Bond Insider

What States Charge The Least Most In Car Taxes Carvana Blog

Oklahoma Vehicle Registration And Title Information Vincheck Info

Used Cars Trucks Suvs In Southwest Ok Solutions Auto Group

Used Cars Trucks Suvs In Southwest Ok Solutions Auto Group

Oklahoma Vehicle Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template Or Waiver In Microsoft W Bill Of Sale Template Bills Oklahoma